Ratings

Bankratings

|

|

Standard & Poor's

|

Moody's

|

|

Emittentenrating |

A+ (stabil)

Issuer Credit Rating |

Aa1 (stabil)

Issuer Rating |

|

Kontrahentenrating |

n/a

|

Aa1

Counterparty Risk Rating |

|

Einlagenrating |

n/a

|

Aa1

Bank Deposits |

|

Eigene Finanzkraft |

bbb+

Stand-alone Credit Profile (SACP) |

baa1

Baseline Credit Assessment |

|

Kurzfrist-Rating |

A-1

Short-term Rating |

P-1

Short-term Rating |

Emissionsratings

|

|

Standard & Poor's

|

Moody's

|

|

Preferred Senior Unsecured Debt |

A+

Senior Unsecured Debt |

Aa1 (stabil)

Senior Unsecured Debt |

|

Non-Preferred Senior Unsecured Debt |

A

Senior Subordinated Debt |

A1

Junior Senior Unsecured Debt |

|

Subordinated Debt (Tier 2) |

N/A

|

A3

Subordinate Debt |

|

Additional Tier 1 Debt |

N/A

|

Baa2 (hyb)

Preferred Stock Non-cumulative |

|

Öffentliche Pfandbriefe |

N/A

|

Aaa

Public Sector Covered Bonds |

|

Hypotheken Pfandbriefe |

N/A

|

Aaa

Mortgage Covered Bonds |

Aktuelle Übersicht der Ratings zum Herunterladen

Aktuelle Ratingberichte

* © by Standard & Poor's, A Division of The McGraw-Hill Companies GmbH; Vervielfältigung nur mit Erlaubnis von Standard & Poor's. Standard & Poor's Ratings Services ist weltweit führend in objektiven, aufschlussreichen Risikoanalysen und Bewertungen der Bonität von Emittenten. Nähere Informationen über Standard & Poor's Ratings, Produkte und Dienstleistungen sind unter http://www.standardandpoors.com/ zu finden.

Archiv Ratingberichte

2024

2023

2022

2021

2020

2019 und älter

2025

2024

2023

2022

- 2022.11.21 Issuer Profil DekaBank

- 2022.11.17 Moodys CO DekaBank

- Rating Action SNP Moody´s (09.11.2022)

- 2022.07.07 Moodys CO DekaBank

2021

- 2021.12.21 Issuer Profil - DekaBank

- 2021.10.29 Moodys CO DekaBank

- 2021.05.17 Moodys CO DekaBank

- 2021.05 Moody's DekaBank

2020

2019 und älter

- 2019.08 Moodys CO DekaBank

- 2019.07 Moodys DekaBank Company Profile

- 2019.02 Moodys CO DekaBank

- 2018.09.11 Moodys German Banks Issuer Ratings

- 2018.08.03 Moody's downgrades senior unsecured debt instruments of German banks

- 2018.08 Moodys CO DekaBank

- 2018.07 Moodys CO DekaBank

- 2018.06.19 Moody's assigns Counterparty Risk Ratings to 26 German Banks

- 2018.05 Moodys DekaBank Company Profile

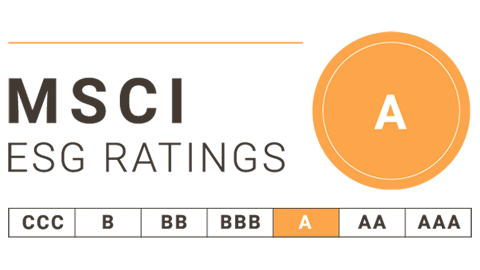

Die Bewertungs-Skalen der Ratingagenturen:

- MSCI: AAA bis CCC (Peer Group: Asset Management & Custody Banks)

- ISS-ESG: A+ bis D- (Peer Group: Financials/Public & Regional Banks)

- Sustainalytics: 0 - 40+ (Peer Group: Asset Management & Custody Services)

THE USE BY DekaBank Deutsche Girozentrale (“Deka”) OF ANY MSCI Solutions LLC OR ITS AFFILIATES (“MSCI”) DATA, AND THE USE OF MSCI LOGOS, TRADEMARKS, SERVICE MARKS OR INDEX NAMES HEREIN, DO NOT CONSTITUTE A SPONSORSHIP, ENDORSEMENT, RECOMMENDATION, OR PROMOTION OF Deka BY MSCI. MSCI SERVICES AND DATA ARE THE PROPERTY OF MSCI OR ITS INFORMATION PROVIDERS, AND ARE PROVIDED ‘AS-IS’ AND WITHOUT WARRANTY. MSCI NAMES AND LOGOS ARE TRADEMARKS OR SERVICE MARKS OF MSCI.

Copyright ©2025 Sustainalytics, a Morningstar company. All rights reserved. This publication includes information and data provided by Sustainalytics and/or its content providers. Information provided by Sustainalytics is not directed to or intended for use or distribution to India-based clients or users and its distribution to Indian resident individuals or entities is not permitted. Morningstar/Sustainalytics accepts no responsibility or liability whatsoever for the actions of third parties in this respect. Use of such data is subject to conditions available at https://www.sustainalytics.com/legal-disclaimers.